The bureaucratic effort is one of the biggest challenges for doctors today when running their practices — complex financial management in particular is often a headache. In this article, we would like to provide you with helpful insights and solutions to simplify the billing process in your medical practice and make it more efficient.

What billing options are there for a medical practice?

The options for financial billing of patients are varied and sometimes incomprehensible. That is why we briefly summarize the most common billing models for you here:

Option 1: Internal fee management

In many medical practices, billing is carried out by medical professionals. With this method, it is the practice to carry out all billing tasks independently — from invoicing to dunning and collection. However, practices often lack specially employed staff dedicated exclusively to this task. Therefore, medical professionals (MFAs), dental specialists (ZFAs) or practice managers also take on responsibility for billing tasks in addition to their regular tasks such as patient care, laboratory tests and assistance with treatments.

Option 2: Pre-financing through a billing agency

If you are unable to take care of your billing yourself or if your practice staff is already working at full capacity, it is possible to outsource your billing. This can be done, for example, by billing service providers to whom you can sell your receivables. In this case, you send your patients' invoices to the billing service provider, who pays you the invoice amount immediately, minus a fee. Your patient only pays the bill after the regular payment period has expired, usually after 30 days.

Real and fake factoring

With this external billing method, a fundamental distinction is made between genuine and fake factoring.

At real factoring The service provider assumes the risk of payment default for you. Example: If your patient does not pay the bill after the payment term has expired, that is not your problem. After all, the invoicer “owns” the invoice and must now take care of recovering the outstanding sum himself.

At fake factoring The invoice amount will also be paid to you immediately. However, if your patient does not pay after the payment period has expired, the billing service provider can claim back the invoice amount that has already been paid to you. The risk of payment default in the case of fake factoring is therefore yours.

Silent factoring and open factoring

In addition, when it comes to pre-financing by a billing office, there is a difference between silent and open factoring.

At silent factoring Does your patient not know that you sold the invoice to a service provider. As a rule, silent factoring is more expensive than open factoring because the service provider cannot carry out a credit check on the patient.

At open factoring Does your patient learn that you have transferred the bill to a service provider. He receives an invoice from a factoring company and not from your practice. Open factoring is the most commonly used form of external billing in German medical practices.

What type of billing should I use in my medical practice?

There is no general answer to which billing method is best for you. Rather, it depends on which aspects you value the most: How much time do you want to save? And how much risk would you like to take on? To make your choice a little easier, Nelly has summarized the advantages and disadvantages of internal and external billing for you:

Advantages and disadvantages of internal billing

With internal billing, it is an advantage that your patients continue to be cared for seamlessly directly by you or by your practice staff after treatment. yours physician-patient relationship can thus be sustainably strengthened. In addition, if you have any questions about an invoice, the contact person is still someone you know personally.

However, a major drawback of this method is that your MFAs and ZFAs spend a lot of time billing. In addition, they may have to take advantage of continuing education and training opportunities for billing. This can further increase the already high workload and stress levels of your practice staff.

Advantages and disadvantages of external billing

Saving time for your staff is a major advantage of external billing. Your MFA or ZFA does not have to do the billing itself and does not need any special training to do so. In addition, you can surrender the risk of payment default with real factoring and are immediately liquid - even without waiting for the patient to receive payment.

But there are also disadvantages with this billing method: For example, open factoring can create initial uncertainty among patients. He finally receives an invoice from a company unknown to him. In addition, service providers sometimes quickly charge high reminder fees, including debt collection. If the patient does not receive the bill on time, for example due to a move, this can quickly become very expensive.

There are also hurdles under data protection law. Remember that you must ask your patients for consent to transfer their data to the factoring service provider.

The solution: billing and factoring with Nelly

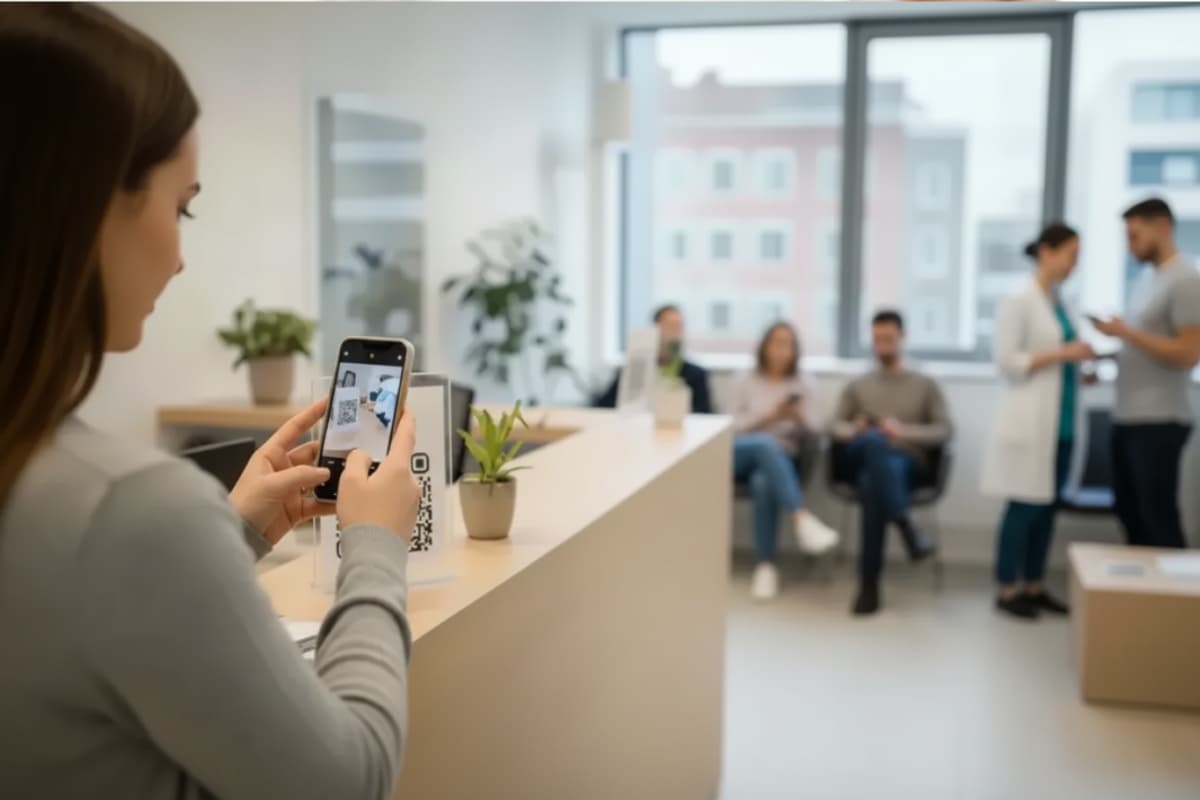

We would like to introduce you to another option that compensates for the mentioned advantages and disadvantages of billing methods: With Nelly, you can outsource billing and therefore time, stress and risk without sacrificing the benefits of internal billing. Because Nelly offers digital invoicing and factoring with cooperating banks as your contractual partner.

If you use Nelly in your practice, your patients already know the name from the digital anamnesis and document management. As a result, patients are not unsettled when they receive a bill from Nelly. You don't have to irritate them with invoices from foreign factoring companies.

This is how billing works with Nelly

With Nelly, you can easily send your patients digital invoices, which they can pay by direct debit, instant transfer or credit card. The invoices do not have to be sent by post, which saves medical staff a lot of time and manual effort. The payment process is so simple and self-explanatory that no further education or training of your practice staff is required. It also reduces your doctor's office's paper, postage and printing costs.

Nelly offers both real and fake factoring. Nelly is also the first provider in the DACH region to be able to develop factoring completely digitally (after a one-time wet signature in practice). Interested? Wir advise you without obligation and free of charge to your individual case!

The personal names used in this article always refer equally to all persons. Dual naming and alternate names are omitted in order to improve readability.